20+ Conventional 97 loan

The 97 program permits a larger loan amount in most US counties 510400 no upfront mortgage insurance and the down payment is 5 lower than an FHA mortgage. Conventional loan with no PMI.

What Is A Loan To Value Ratio Gobankingrates

The new conventional 97 LTV program is a safer bet for the future requiring no upfront mortgage insurance fees and cancellable monthly PMI.

. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. A Conventional 97 is a conventional mortgage that requires only 3 down. By providing 97 loan-to-value LTV financing options that help lenders better serve first-time homebuyers.

Begin Your Loan Search Right Here. That means the loan-to-value or LTV ratio can be up to 97 hence the 97 in the name Conventional 97. Find A Lender That Offers Great Service.

Piggyback loan no PMI. Get my lender match. The loans you know with down payments that will surprise you.

The 97 LTV Conventional Loan borrowers need to qualify for the standard Fannie Mae andor Freddie Mac lending guidelines with regards to eligibility requirements such as the. May 17 2017 April 20 2017 JMcHood 0 Comments conventional 97 mortgage conventional mortgage guidelines fannie mae loan programs new home buyer loans. Youll also hear loan officers refer to this as 20 home equity both terms essentially refer to the same.

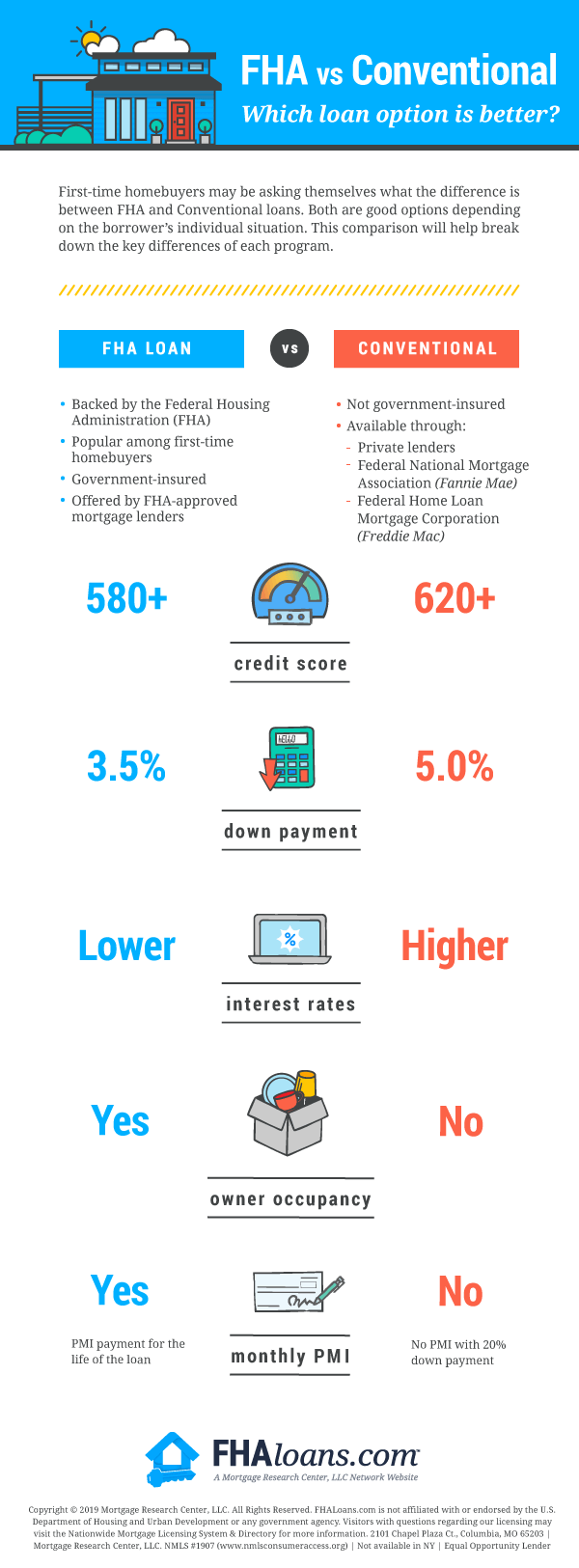

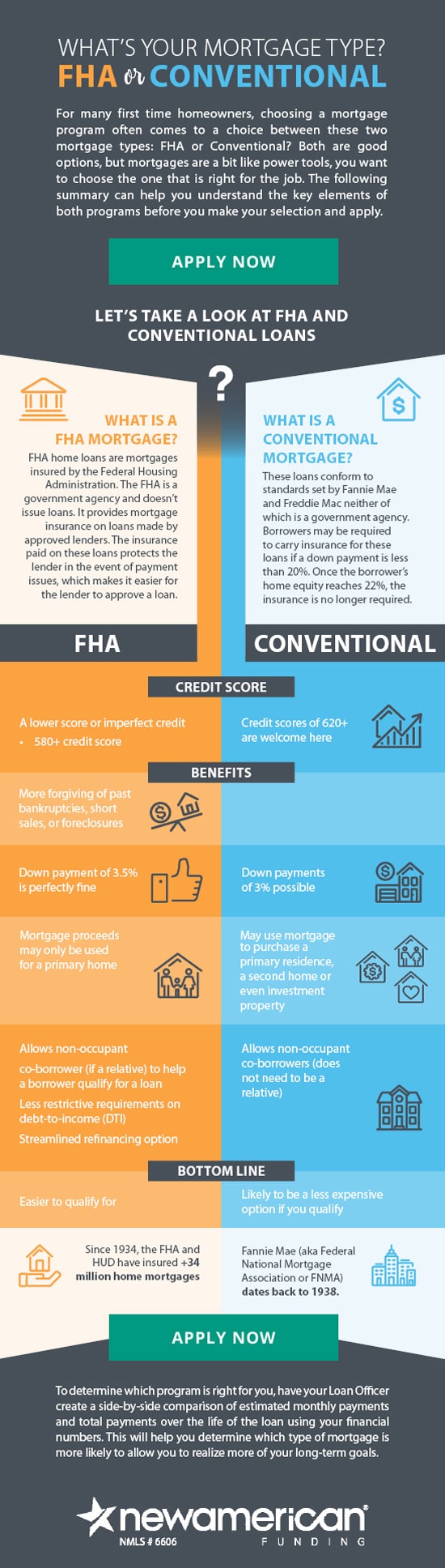

Ad Were Americas 1 Online Lender. However they usually require down payments that are in the 5 to 20 range. First-time homebuyers can qualify for Conventional 97 Mortgages with a 3 down payment which is lower than the 35 down payment required on FHA loans.

As the name implies a Conventional 97 loan is a mortgage that allows you to have a loan-to-value LTV ratio of as high as 97. Conventional loan with PMI. In all cases youll need at least 5 equity.

This means that if you are purchasing a home with a 100000. As the name implies a Conventional 97 loan is a mortgage that allows you to have a loan-to-value LTV ratio of as high as 97. This means that if youre purchasing a home with a 100000.

Some lenders also offer 10-year 15-year and 20-year fixed rate loans. Well Help You Get Started Today. Compare More Than Just Rates.

Choose The Loan That Suits You. A conventional 97 loan is a type of mortgage loan that requires a down payment of just 3. From the 10 down piggyback loan to 3.

2022 Conventional 97 Loan Requirements Additional conventional 97 loan requirements in 2022 include. Get All The Info You Need To Choose a Mortgage Loan. Conventional 97 mortgage insurance goes away at 80 loan-to-value.

APGFCUs Conventional 97 and 95 programs 1 offer even more options to help you move into your first house without. Many buyers choose a 30-year fixed-rate conventional loan because it usually results in an affordable monthly payment but shorter terms are also available. Ad Were Americas 1 Online Lender.

The mortgage is a fixed-rate loan The property is a one-unit. Con un préstamo Conventional 97 usted puede pagar tan sólo un 3 de pago inicial. With a Conventional 97 loan you can pay as little as 3 down.

The definition of a. Ad Explore Quotes from Top Lenders All in One Place. Ad It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan.

5 to 1999 down. Esto significa que la relación préstamo-valor o LTV por sus siglas en inglés puede. If youre doing a cash-out refinance youll need to leave at.

The 97 in the name refers to the loan-to-value ratio of 97 that youll have when you. Eligibility and Terms Desktop Underwriter DU underwriting required 1-unit. For an in-depth comparison of PMI and FHA mortgage insurance see our post that compares FHA to the Conventional 97 loan.

Get the Right Housing Loan for Your Needs. Compare Offers Side by Side with LendingTree. Its named for the remaining 97 of the homes value that the mortgage will finance.

2019 conventional 97 ltv. Well Help You Get Started Today. Conventional loans can also offer adjustable-rates that change in accordance with broader market conditions.

There are now some conventional loan programs that offer down payments as low as 3 percent of. Can a second mortgage eliminate PMI. If youre refinancing a conventional loan youll need more than 3 equity.

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information Fha Loans Refinancing Mortgage Mortgage Loans

Fha Loan Pros And Cons Fha Loans Home Loans Buying First Home

Conventional Mortgage Outlet 52 Off Www Ingeniovirtual Com

Conventional Mortgage Outlet 52 Off Www Ingeniovirtual Com

5 Reasons Why A 20 Year Mortgage Is A Great Option Credit Sesame

Conventional Mortgage Outlet 52 Off Www Ingeniovirtual Com

Kentucky Fha Loans Compared To Kentucky Conventional Loans Kentucky First Time Home Buyer Programs For 2 Fha Loans Conventional Loan Mortgage Loan Originator

Conventional Mortgage Outlet 52 Off Www Ingeniovirtual Com

Cumulative Distribution Of Home Loans By Borrower Income And By Download Table

What Is The Minimum Down Payment Requirement To Buy A Home Find My Way Home

Fha Loan With 3 5 Down Vs Conventional 97 With 3 Down Fha Loans Mortgage Approval Mortgage Interest Rates

Academy Now Offers Conventional 3 Down Or Conventional 97 Loans A Fannie Mae Program For Homebuyers With Limited Fu Mortgage Home Buying Mortgage Marketing

2022 Guide To Qualifying For A Mortgage With Student Loans Find My Way Home

Conventional Low Down Payment Options For Purchase Or Refinance Find My Way Home

Conventional Mortgage Outlet 52 Off Www Ingeniovirtual Com

Conventional Mortgage Outlet 52 Off Www Ingeniovirtual Com

Minimum Down Payment For A Conventional Loan In California